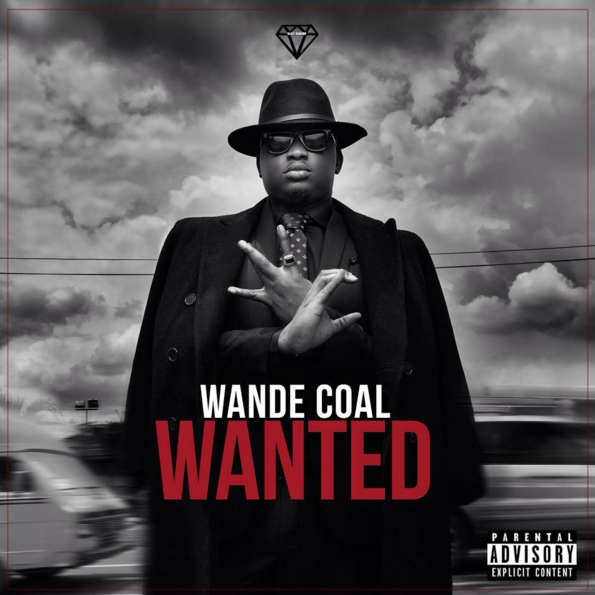

Artist: Wande Coal

Album Title: Wanted

Label: Black Diamond Entertainment

Release Date: October 26, 2015.

Wande Coal’s long awaited sophomore effort finally dropped last week, announced with little fanfare from the artist himself. ‘Wanted‘ set the Nigerian music scene aflutter until its actual release. The album title itself is a play on the demand for a follow up record from an artiste who had been quiet mostly since his acrimonious split from the then young Mavin Records other than featuring on one of the songs of the year, Patoranking’s My Woman, My Everything and his well received 2014 single Baby Hello.

Theories abound as to why it’s taken him this long. His debut was a runaway success; the album is still referenced as the best debut by a Naija pop act and, try as he might, the artistic (and commercial) success of that record is inescapable.

Wande Coal‘s frustration at being constantly reminded of M2M is understandable, he was just making music as he knew how with an equally hungry producer in Don Jazzy. It’s not his fault that he happened to produce an album that resonated so strongly with the public; he shouldn’t be forever bound to repeat the pop perfection that was M2M. He made aspirational music; it was introspective, sweet and most importantly, he had the joie de vivre of a young man just having fun and hoping the good times would continue. There was no pressure of expectations, no mark for him to beat and much has been said on the synergy between Coal and his former boss and collaborator. He deserves to be, ideally, judged on the merit of this work, Wanted. But he earned the love and expectations as a result of that album and this time around, there’s a plethora of other talented artists for him to jostle for attention with as well as contending with dizzying expectations.

Coal clearly sought out a Jazzy-like relationship with Maleek Berry, the UK based producer who was handed the responsibility of crafting the follow up to the monster that is M2M. Coal works best under direction, Jazzy’s signature is all over M2M, be it on background vocals or from Coal opening tracks by signing the now famous refrain, ‘it’s Don Jazzy again’. Berry does not have the same gravitas, not owing to the obvious fact that he’s not Jazzy but he could not make Coal challenge himself vocally. If nothing else, Coal is a top notch melodist. Save for one song, Lowkey, that wasn’t obvious on this album. Berry doesn’t have necessary dexterity as a beat-smith to have been handed the responsibility of chief producer for this project. His beats are good-ish, think Back To The Matter ft. Wizkid, Saucekid’s Carolina but Berry has yet to show that he understands melody in the way Coal’s vocals demand it.

The power dynamics between the two probably saw Coal dictating the production moves, speculation of course but, he clearly needed more and different than what Berry has been able to deliver here.

The album opens properly with Adura, featuring Coal’s famous falsetto. As well as this, the high points of the album come on the Legendury Beats produced Monster and it’s Coal in his element; brash, almost new school rapper delivery, then there’s Lowkey where he and Berry work in delightful tandem; a summer type, versatile fun record. Ashimapeyin also works really well, Coal’s self assured delivery over Sarz’s well matched efforts on the beat.

The low and middle points are plenty though, too many joints sound the same. Same Shitfeat. AKA sounds like the rhythmic crashing of kitchen utensils on surfaces, Make You Minefeaturing 2face Idibia doesn’t work, which is a shame. On paper, these two should have been able to create something memorable. SuperWoman is alright but it sounds like too many songs we’ve heard before, it’s however, a good vocal performance. The Sarz produced Wanted Remix is better than the original. Kpono feat Wizkid is good for Wande’s delivery, which was razor sharp and Wizkid does as expected; ‘Breaking my fast tonight, many regards tonight, I no lose guard tonight’. The song should be one of the songs of the festive season, not because it’s a particularly good club song, it’s just alright, but it’ll find its way onto DJs’ playlists because his audience wanted a dance tune from him a la You Bad/Bumper To Bumper, and this is the closest track on the album.

Too often Wande Coal phones it in on tracks. He can sing – really well – and perhaps that fueled the false sense of comfort he felt in making the ill thought out African Lady, an amateurish imitation of a highlife record or the eye roll inducing obligatory wedding track,Iyawo Mi. Yes, Berry doesn’t have the heft needed but Coal should have kept his ear to streets for the sounds and vibes of the times. He couldn’t create a wave here, none of the Fuji-pop infusion found on his first record or the believable crooning either. Ironically, the skit by Falz was intended as a tongue-in-cheek acknowledgement of what his critics had been saying about his reluctance to drop a follow up, “Wande Coal, the problem with him is his chronic lack of focus ”, it’s intended figuratively but one cannot help but conclude that there’s a kernel of truth in it. There’s no artistic hunger here.

Amorawa featuring Burna Boy should have been to Wanted as Street Credibility was 9ice’sGongo Aso, a timeless anthem for the man dem but as is apparent by now, the A&R and direction was missing on the project. This gem of a track should have been kept under wraps until the album was released. Sans Ashimapeyin, there are no signature joints on the album, no take away melodies; the replay value, already stunted by the album’s length, is very low.

It’s almost baffling that Wande Coal came up so short. His last major release was six years ago, enough time for him to hone his craft. Further, the fallout with his erstwhile production team ought to have provided the fillip to drop if not another classic, then an excellent record. Perhaps he was panicked by his hiatus, but an audience that waited this long would have waited another year if that’s what it would have taken for him to release a worthy record. But this is Wande Coal, probably the most talented pop singer on the Nigerian pop music scene, it’s hard to imagine he’d be pleased with this offering; he is capable of so much more. This isn’t what we “Wanted” but it’s what he served up.

Adura, Monster, Lowkey, Ashimapeyin, and Superwoman are the album’s best tracks. Four good new songs on a 17 track album is not good enough, Wanted has been found wanting but that said, it’s nice to see Wande Coal back as a pop performer.

This album is rated 5/10

You can follow Tola Sarumi on Twitter :-

@AfroVII

\

\